Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Netflix readies two-pronged approach to accelerate games adoption

Netflix has recently revealed plans to encourage adoption of the games catalog that it offers as part of a standard subscription. This is set to become part of a two-pronged strategy: Netflix Stories will strengthen its content offering, while Games on TV focuses on widening access.

Netflix has recently revealed plans to encourage adoption of the games catalog that it offers as part of a standard subscription. This is set to become part of a two-pronged strategy: Netflix Stories will strengthen its content offering, while Games on TV focuses on widening access.

Netflix’s games offering has yet to reach its potential

Almost two years have passed since Netflix launched its gaming service in late 2021. Despite this, there lies plenty of untapped potential for the company to utilize games to keep subscribers as a retention play – to keep them using its service over competing entertainment options such as Fortnite and Roblox.

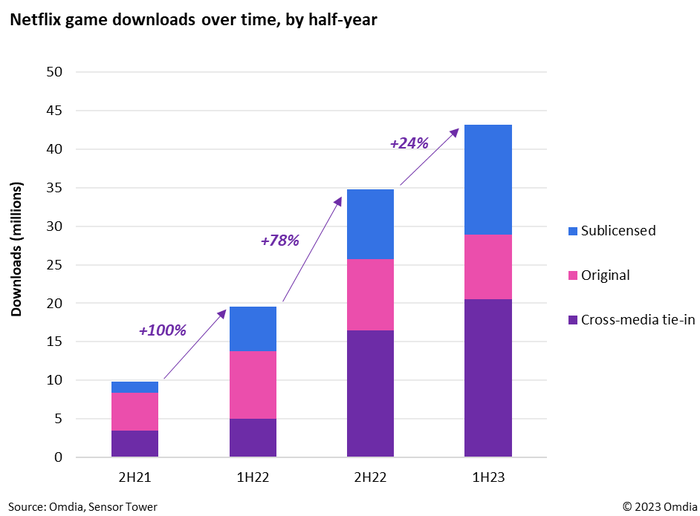

Netflix Games’ launch was certainly muted – Omdia analysis of Sensor Tower data tells us that just under 5 million games were downloaded each month across iOS and Android devices during 2H21, tiny in comparison with Netflix’s 222 million subscribers at the time (see Figure 1).

In other words, in a best-case scenario, just 1 in 22 Netflix subscribers downloaded a game during the service’s 2H21 launch window.

Adoption has since picked up with sustained growth in downloads every half-year. In 1H23, Netflix’s games were downloaded over 43 million times from iOS App Store and Google Play, a substantial increase YoY of over 120%, but again, suggests that in a generous best-case scenario, just under 1 in 7 of the company’s 284 million subscribers downloaded a game over a six-month period.

Netflix’s upcoming plans to expand its games offering suggest the company has begun to understand the types of games that resonate strongly with its customers, while also recognizing that keeping its games on smartphones and tablets is not enough to reach the majority of its subscribers.

Figure 1: Cross-media titles accounted for almost half of Netflix Games’ downloads in 1H23

Netflix Stories bolsters its most promising cross-media games lineup

Netflix has revealed a new series of cross-media tie-in games that will hit the service in the third quarter of 2023: Netflix Stories. The idea is to expand upon existing Netflix IP with narrative-driven titles, starting with reality show Netflix Stories: Love is Blind.

Netflix Stories’ focus on enriching its TV and film series is a smart move and suggests the company has begun to understand which mobile games resonate strongly with its audience.

Omdia’s Mobile Games Report – 1H23 categorizes Netflix’s lineup of titles released to date into three buckets:

Original: Original content produced specifically for or by Netflix Games, but not part of a Netflix TV or film tie-in. The majority are exclusive to the Netflix Games catalog. Examples include Valiant Hearts: Coming Home, Classic Solitaire, and Reigns: Three Kingdoms.

Sublicensed: Previously released titles, sublicensed to Netflix Games by another publisher, such as Asphalt Xtreme, Terra Nil, and Bloons TD 6. If on mobile, the original release is delisted and in-game purchases removed. If on PC or console, Netflix gains exclusive publishing rights to the mobile version.

Cross-media tie-in: A cross-media release that directly ties in with an existing TV show or film available for streaming on Netflix, such as Too Hot to Handle: Love is a Game, and Nailed It! Baking Bash.

Of these three categories, Omdia analysis of Sensor Tower data reveals that cross-media tie-in titles have, by far, been the most successful at garnering adoption among subscribers (see Figure 1).

This shouldn’t come as a surprise considering Netflix’s games always had most potential as a means of keeping its viewers’ eyeballs on Netflix – an engagement play. In a saturated games market, few will be subscribing to Netflix to primarily play games, but those games which extend or enrich familiar Netflix properties have the best chances of resonating with an audience who primarily subscribes to access TV and film.

The relative success of December 2022’s Too Hot to Handle: Love is a Game, is perhaps the best illustration of this. It launched concurrently with Season 4 of the TV show and quickly became Netflix’s most downloaded game to date. Cross-media tie-in titles now account for almost half of downloads across Netflix’s games library.

Despite their relative success, Omdia analysis of the Netflix Games catalog reveals that cross-media games make up just 15% of titles on the service. Ensuring the company has ample cross-media content makes Netflix Stories a savvy investment.

It’s also a good utilization of its internal development talent. Netflix Stories: Love is Blind is under development at Boss Fight Entertainment, a company Netflix acquired in 2022. Sensor Tower data tells us its last release, Dungeon Boss: Respawned, was downloaded only just over 60,000 times. Pivoting toward utilizing Netflix IP customers are already familiar with is a wise move.

Netflix expands to bigger screens with Games on TV

The second pillar around games that Netflix is strengthening is access. Since the company is currently committed to offering games as part of a subscription only, the screens which its subscribers are engaging with play a huge role in their discovery and engagement.

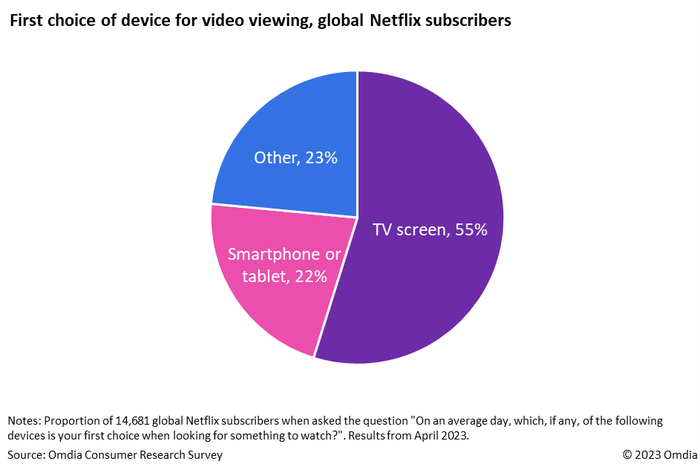

At present, Netflix’s mobile games are limited to smartphones and tablets only. Yet Omdia’s Consumer Research Survey conducted in April 2023 reveals Netflix subscribers’ first choice of device is the TV, by some distance (see Figure 2).

Figure 2: TV screen the first choice for viewing for over half of Netflix subscribers surveyed by Omdia

This is where Netflix’s new “Games on TV” offering comes in. Currently in beta, Netflix is rolling out cloud streaming of select games to smart TVs and additional devices such as streaming boxes.

By seamlessly integrating its games with the TV apps that its subscribers prefer engaging with, Netflix can significantly reduce the friction involved in onboarding its users. Games can be placed next to TV and film in the app’s front-end before being served instantly via cloud server.

This is a huge improvement over its previous dependence on mobile devices, which Omdia’s data shows only 22% of its subscribers prefer to use to access Netflix, making it much more likely they may never come across its games.

As Omdia wrote in August 2022, gaming’s presence on smart TVs has largely been limited to console gaming, with the most successful cloud gaming services also being aimed at this same audience rather than the wider market of casual gamers. There is potential for Netflix to bring big-screen TV gaming to this wider audience.

This will not be without its challenges. For one, Netflix is using smartphones as a means of controlling its games on smart TVs, not dissimilar to AirConsole’s approach.

While this solves one pain point of adoption – the need to own a compatible game controller – it introduces its own issues. An additional app download is required, while pairing a smartphone for each play session adds extra steps for its users.

More concerning is Netflix’s decision to use players’ smartphone controllers to display an on-screen, virtual control pad and buttons that players will not feel with their thumbs. This absence of tactile feedback leads to a particularly sub-optimal experience when players’ attention is focused on the big screen. If this frustrates them, they could churn.

Bespoke, clearly labelled interactive on-screen inputs for each game could prove to be more intuitive in games featuring less action, but their integration requires time and effort from developers.

The use of the cloud as a delivery mechanism also limits the types of games Netflix can serve to its customers. Streaming GPU-intensive console and PC games over the cloud, like Amazon does with Luna and Microsoft with Xbox Cloud Gaming, is expensive. Games streaming is also notably more data intensive than video streaming, impacting infrastructure costs further.

Netflix does not intend to stream graphically intensive titles any time soon, particularly as it offers games for no extra cost as part of a subscription. But this limits its streaming catalog to more cost effective titles similar to those it already offers on mobile.

Bringing games to smart TVs certainly has potential to solve a discoverability issue for Netflix, then, but its dependence on smartphones as game controllers, coupled with the potentially limited library of games it can deliver via the cloud, make for a potentially costly experiment.

As with Netflix’s previous moves in games to date, this is clearly a learning process. Netflix has shown, historically, that it is happy to invest and take its time when cracking new market opportunities. It took a decade for Netflix to find its feet with video streaming.

We’re beginning to see similar parallels with gaming. The past two years have shown that Netflix, unlike the wealthy non-gaming companies which failed to break into gaming – has the perseverance required to make this work. Its reinvestment in more cross-media titles with Netflix Stories suggests it now understands what works with its mobile games offering.

Yet Netflix’s success is far from guaranteed. It remains unclear whether the gains made from engaging its video streaming beyond TV and film are ultimately worth the costs associated with running game development studios, making games, and operating a cloud service.

Appendix

Further reading

Mobile Games Report – 1H23 (August 2023)

Consumer Research – Devices Media and Usage Database (August 2023)

Mobile Games Title Performance Database (July 2023)

Smart TVs will ready gaming for primetime (August 2022)

What a year’s data tells us about Netflix’s games strategy (December 2022)

Author

James McWhirter, Senior Analyst, Games

Citation Policy

Request external citation and usage of Omdia research and data via [email protected].

Omdia Consulting

We hope that this analysis will help you make informed and imaginative business decisions. If you have further requirements, Omdia’s consulting team may be able to help you. For more information about Omdia’s consulting capabilities, please contact us directly at [email protected].

Copyright notice and disclaimer

The Omdia research, data and information referenced herein (the “Omdia Materials”) are the copyrighted property of Informa Tech and its subsidiaries or affiliates (together “Informa Tech”) or its third party data providers and represent data, research, opinions, or viewpoints published by Informa Tech, and are not representations of fact.

The Omdia Materials reflect information and opinions from the original publication date and not from the date of this document. The information and opinions expressed in the Omdia Materials are subject to change without notice and Informa Tech does not have any duty or responsibility to update the Omdia Materials or this publication as a result.

Omdia Materials are delivered on an “as-is” and “as-available” basis. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information, opinions, and conclusions contained in Omdia Materials.

To the maximum extent permitted by law, Informa Tech and its affiliates, officers, directors, employees, agents, and third party data providers disclaim any liability (including, without limitation, any liability arising from fault or negligence) as to the accuracy or completeness or use of the Omdia Materials. Informa Tech will not, under any circumstance whatsoever, be liable for any trading, investment, commercial, or other decisions based on or made in reliance of the Omdia Materials

Read more about:

Featured BlogsAbout the Author(s)

You May Also Like

.jpeg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)