Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

How handheld gaming has become more complex – and more lucrative

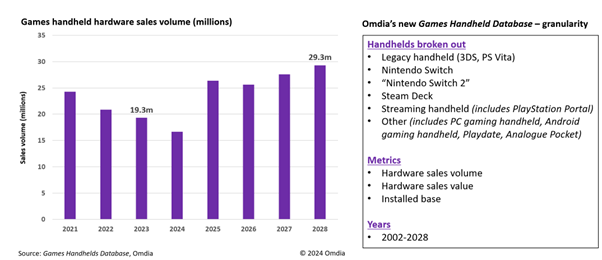

This piece explores the recent development of the market, guided by Omdia's brand-new Games Handheld Database, which forecasts value, volume, and installed base through to 2028 across all key devices and categories of dedicated gaming handheld.

Following the success of 2017’s Nintendo Switch, dedicated handheld gaming has rebounded. Handheld gaming has since transformed from what used to be distinctive hardware served almost entirely by a library of exclusive software, toward devices that sit adjacent to existing market segments of console, PC, and mobile.

This piece explores the recent development of the market, guided by Omdia’s brand-new Games Handheld Database, which forecasts value, volume, and installed base through to 2028 across all key devices and categories of dedicated gaming handheld.

Dedicated handheld gaming has seen a resurgence since Nintendo Switch

Before Nintendo launched Switch in 2017, the market for dedicated gaming handhelds, as popularized by 1989’s Game Boy, took on a very different form. Technological boundaries between stationary and mobile hardware meant handheld gaming hardware could not closely align with consoles at the time, which in turn mandated a different approach to games development.

The result was platforms like Nintendo DS, Sony PSP, and Game Boy Advance – handheld games platforms which were served almost entirely by their libraries of exclusive software. This helped them carve out a market that lay separate to console and PC gaming through their respective eras.

Yet the very definition of handheld gaming has transformed significantly since the Nintendo 3DS and PlayStation Vita were cannibalized by mobile as the primary means of gaming on the go.

Without a large enough active installed base to make bespoke software sustainable, third-party publishers had begun to prioritize mobile, console, and PC games over the handheld market they once eagerly supported. The old model of handheld gaming became unsustainable.

It is no surprise, then, that Nintendo went in a different direction with Switch. Instead of producing a platform that stood on its own, separate from PC, console, and mobile, Switch instead was designed to sit adjacent to the console market. It no longer had to be pocketable, so a tablet-like form factor made way for active cooling, a large display – suitable for console games and local multiplayer – and flexible controller support.

This shift was made possible thanks to the emergence of key technologies. The Nvidia processor powering the Switch is capable of the same graphical feature set as PS4 and Xbox One, while Switch’s launch-day support for Unity and Unreal Engine 4 also ensured the platform was ready for the newly emerged norm for multiplatform games development.

The rest is, of course, history. Switch arrived at the right time to realize a new vision of console gaming on the go, and it will likely surpass Nintendo DS to become Nintendo’s best-selling console of all time. Legacy handhelds such as Nintendo 3DS now feel thoroughly “retro” due to how little they resemble modern handheld gaming.

Handheld gaming now lies adjacent to PC, console, cloud, and mobile

If the Switch was about successfully distilling everything that defines console gaming into a portable form factor, 2022’s Steam Deck successfully managed the same feat – but instead with PC gaming.

Rather than require bespoke ports of PC games, Valve utilizes a compatibility layer – Proton – to translate thousands of Windows games to SteamOS, Steam Deck’s Linux-based operating system built specifically for handheld gaming. This helped Valve immediately tap into its Steam content library for the device’s launch window.

As a result, a new product category was created: the PC gaming handheld. Major gaming PC hardware makers – ASUS, Lenovo, MSI – have since released their own devices that sit adjacent to the PC gaming notebook and desktop segment. For these manufacturers, handhelds are a means to ensure that customers looking for portable gaming options can continue to engage with their PC gaming-specific brands.

Likewise, streaming handhelds such as Sony’s PlayStation Portal and the Logitech G Cloud allow PS5 owners to engage with their consoles away from a primary living-room TV via local streaming. For Valve and Sony, handheld gaming is a value-add to existing platforms, extending their ecosystem of games to portable play.

This is becoming more important for platform holders as gaming content becomes increasingly platform-agnostic, with cross-platform multiplayer and progression also breaking down the network effects of platform lock-in.

Indeed, Omdia’s Consumer Research Survey conducted in November 2023 reveals that, globally, over one in three PS5 owners already own a Nintendo Switch. This proportion is even higher in the US, the territory with the largest active installed base of PS5 consoles.

With viable handheld gaming options now existing adjacent to major gaming platforms such as PlayStation and Steam, such devices are well positioned to help with platform retention, especially as Nintendo’s next-generation handheld console is expected to launch within the next 12 months.

Niche categories of dedicated gaming handheld have also emerged. The Analogue Pocket caters to an enthusiast audience interested in revisiting gaming history, while Panic’s Playdate aims to fill the gap left by legacy handhelds with a device so different it mandates developers create games specifically for it.

The contrast between the outgoing generation of handheld hardware and now is clear: Dedicated handheld games systems are no longer a singular slice of the games market, instead lying adjacent to the PC, console, and mobile markets.

When combining these categories together using Omdia’s Games Handheld Database, 19.3 million units of dedicated handheld gaming hardware were estimated to be sold through to consumers globally in 2023. This is set to grow to 29.3 million units by 2028 (see Figure 1).

Figure 1: Dedicated handheld games hardware by product category

A clear vision will be required for emerging handhelds to succeed

While the emergence of new product categories in the dedicated handheld gaming space no doubt provides an opportunity for platform holders, components manufacturers, and software vendors, the short-term opportunity for many hardware makers remains less clear.

Let’s start with the PC gaming handheld segment. While emerging devices like ASUS ROG Ally or Lenovo Legion Go can clearly differentiate itself from Steam Deck with more capable hardware – a key characteristic of PC gaming, in fact – it is important to note that the market dynamics within this product category are different from gaming desktop and notebook PCs.

Consider how the company synonymous with PC gaming in many major territories, Valve, is selling its own hardware more competitively by following the console model – it is earning the majority of its post-sale revenue back via software sold on Steam.

This is an arrangement that is entirely unique to the handheld space, impacting other hardware makers’ competitiveness as they are not primarily software companies, making them more dependent on revenue earned upfront via hardware sales.

PC hardware makers are also shipping handhelds with an operating system they do not control. This has translated into an inferior user experience as Windows continues to be poorly optimized for the handheld form factor.

Microsoft will need to engineer a version of Windows and its Xbox services that is purpose-built for handheld gaming. Valve could also license SteamOS to other manufacturers while optimizing it to work on other devices than its own. As such, it will be in territories where Steam Deck is unlikely to launch that devices such as the ASUS ROG Ally and Lenovo Legion Go can penetrate the PC gaming market.

This is also true for emerging dedicated Android gaming handhelds such as AYANEO’s Pocket S, which could find an audience in territories that gravitate heavily toward core mobile gaming, such as China. Yet success is both risky and unlikely to materialize in the short term – note that not only does AYANEO not manufacture devices in high volumes, but the once-promising segment of gaming smartphones is currently faltering.

Future streaming handhelds with their lower average selling price could be designed to sit adjacent to high-end PC gaming. Yet unlike PlayStation Portal – which draws from a massive singular installed base of active PlayStation 5 systems – similar devices designed to pair with a gaming desktop or PC will be dealing with a more fragmented market across multiple PC gaming brands.

Likewise, the potential for cloud streaming handhelds will depend on the market penetration and adoption of cloud gaming solutions – which currently are very much wedded to console subscriptions such as Xbox Game Pass Ultimate. Cloud gaming providers ought to be emphasizing the availability of their services on emerging streaming handhelds.

This all underscores the difficulty of building a new hardware business without the controlling software ecosystem. While Nintendo Switch, Steam Deck, PlayStation Portal and their upcoming successors are established products that will continue to lead the handheld gaming categories that lie adjacent to console and PC gaming, it is clear that emerging device categories will need a clear long-term vision to realize their full potential.

About the Author(s)

You May Also Like

.jpeg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)